Montana Bill of Sale Form – Download Free Template

Selling or buying a vehicle in Montana? A bill of sale provides proof of purchase, protects both parties, and helps with title registration. Without it, you risk disputes or legal issues if anything goes wrong after the purchase.. Get your free Montana Bill of Sale template today!

What is a Montana Bill of Sale?

A bill of sale is an essential document that records the transaction details between a buyer and a seller. It serves as proof of ownership, provides legal protection, and may be required for vehicle registration, tax filing, or title transfers.

Whether selling a car, truck, trailer, or boat, having this document benefits both parties. Keeping a copy helps prevent disputes, ensures clarity in agreements, and can be useful for future legal or financial concerns.

Why Do You Need a Bill of Sale in Montana?

A bill of sale does more than just record a transaction; it protects the sellers and buyers alike. Here are more reasons why both sellers and buyers need to have a bill of sale.

For Seller

- Protection from Liability: Once a vehicle is sold, a bill of sale confirms the ownership transfer, ensuring the seller is no longer responsible for parking tickets, accidents, or other legal matters tied to the vehicle after the sale.

- Accurate Tax Records: The bill of sale includes the final selling price, which helps the seller report the correct amount for tax purposes. This prevents potential audits or disputes regarding how much the vehicle was sold for.

- Preventing Ownership Disputes: If a buyer fails to transfer the title or register the vehicle properly, the bill of sale acts as proof that the seller no longer owns it, protecting them from future ownership claims or legal troubles.

For Buyers

- Establishing a Valid Ownership Record: The bill of sale proves that the buyer legally purchased the vehicle or vessel. It confirms that ownership has changed hands and protects the buyer from claims made by a previous owner or dealership.

- Preventing Fraud and Misrepresentation: A bill of sale records key details such as the agreed sale price and odometer reading. If the buyer later finds discrepancies, this document serves as proof to resolve disputes or take legal action if needed.

- Required for Registration and Taxes: In many states, a bill of sale is necessary for registering a vehicle or boat. Some DMVs also require a notarised copy for title transfers and tax reporting, making it an essential document for legal compliance.

Different Types of Bill of Sales in Montana

Montana has two primary bills of sale, which are the general bill of sale and the vehicle bill of sale. Those two bills of sale are used for different purposes, as the general bill of sale is used for any transaction aside from the vehicle, whilst the vehicle bill of sale is used for any kind of vehicle transaction.

General Bill of Sale

The general bill of sale is used for property other than vehicles (e.g., livestock, equipment). This is not legally required, but recommended for legal protection. It can be handwritten or digital, as long as it includes key details and signatures of both parties.

Vehicle Bill of Sale (MV24)

A Vehicle Bill of Sale (Form MV24) is a notarised document required for all private vehicle sales in Montana, serving as proof of the transaction and allowing the buyer to register and title the vehicle.

What Should Be Included in a Bill of Sale in Montana?

The Montana bill of sale should have written down all the detailed transactions of the vehicle/vessel, including the details of the seller and buyer.

Buyer and Seller’s Information

The full names, addresses, and phone numbers of both the buyer and seller must be written clearly. This information ensures that both parties can be contacted in case of disputes or verification during registration.

Vehicle Description

The bill of sale should include essential details about the unit, such as the make, model, year, and Vehicle Identification Number (VIN), ensuring the proper identification of the asset in legal records.

Date of Sale and Purchase Price

Clearly, writing the sale date and final purchase price helps avoid confusion or disputes later. This information is crucial for tax reporting and proves the agreed-upon amount paid at the time of purchase.

Odometer Reading (For Vehicles Only)

Many states require the odometer reading at the time of sale. This prevents mileage fraud and ensures that the buyer receives an accurate record of the vehicle’s true usage history.

Signatures of Both Parties

Both the buyer and the seller must sign the bill of sale to confirm that all details in the document are correct. Without signatures, the document may not be legally enforceable in case of disputes.

Registering a Vehicle in Montana

If you are a new resident, you must register your vehicle within 60 days of moving to the state. The process requires a visit to your local County Treasurer’s office.

Required Documents

You must gather the following items before visiting the office:

- Original Title: The physical title, signed over to you by the previous owner (for used vehicles).

- Proof of Identity: Your Montana driver’s license or ID.

- Proof of Residency: If you have an out-of-state license, you will need documentation like a property ownership document, a lease agreement, or utility bills addressed to you in Montana.

- Loan Information: If you have a loan, you must request that your lender send the out-of-state title directly to the Montana County Treasurer’s office. A specific state form may be required for this request.

Registration Process

- Contact Lender (if applicable): If you have a loan, contact your lender immediately to ensure they mail the out-of-state title to the correct Montana office.

- Gather Documents: Collect the original title, your ID, and proof of residency.

- Visit the County Treasurer’s Office: Go in person to your local office. It’s often recommended to call ahead and schedule an appointment.

- Complete the Process: Submit your paperwork, select your license plates, and pay all required registration fees.

Special Considerations

- Out-of-State Titles: If transferring an out-of-state title that is held by a lienholder, the lienholder must send the title directly to the Montana office, not to you.

- LLC Registration: Registering a vehicle under a Montana LLC involves a separate, distinct process, including forming the LLC and obtaining a registered agent.

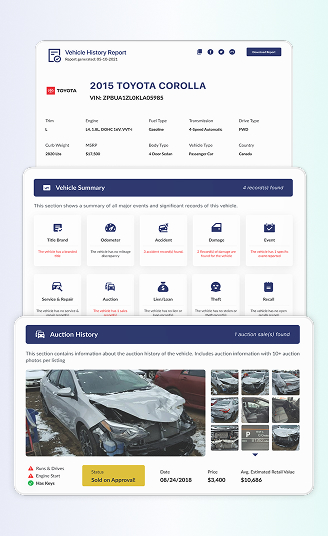

Montana VIN Check – Verify Vehicle History Before You Buy

Be sure to check the VIN and get the report before you decide to purchase the vehicle. Check the specifications and the records, like ownership history, title, odometer reading, and accident history.

Mileage History

Title Brand

Ownership History

Warranty Status

Sales History

Salvage Title

Usage History

Repair Cost

Auction History

Hail Damage

Ownership Duration

Recalls History

Accident History

Flood Damage

Lien & Loans

Maintenance Schedule

Get a Vehicle Bill of Sale by State

Each state has its own requirements for an auto bill of sale. Click below to find the template for your state!

FAQs About Montana Bill of Sale

Does it matter whose name is on the car?

Yes, the name holder of the car does matter. Car insurance can be affected by who’s listed as the owner on the title since insurers typically need the policyholder to have ownership or a financial stake in the vehicle.

What documents do you need to register your vehicle in Montana?

Montana requires vehicle registration after purchase, which can be done online or in person at the MVD Express by presenting the car’s title, insurance details, and a valid driver’s license and paying the required fee.

Can a bill of sale be zero dollars?

While not universally mandatory, a bill of sale detailing the previous owner, odometer reading, and purchase amount is still recommended in many states. If the car is a gift, state $0 as the price, keeping in mind that title transfer fees may still apply to the family member receiving it.

Does the Montana bill of sale need to be notarised?

No, Montana no longer requires a notarised bill of sale for vehicle transfers. While keeping a bill of sale is recommended for record-keeping, notarization is not legally needed for vehicles, watercraft, or snow vehicles, and a notarised signature on the title itself is no longer required.

How to write a bill of sale in Montana?

To create a Montana bill of sale, include the following details:

- Date of sale

- Full names and contact information of both buyer and seller

- Sale price or purchase amount

- Detailed description of the item being sold

- Confirmation that the item is free of liens or claims

- Any ongoing terms, like warranties, if applicable

- Signatures of both the buyer and seller