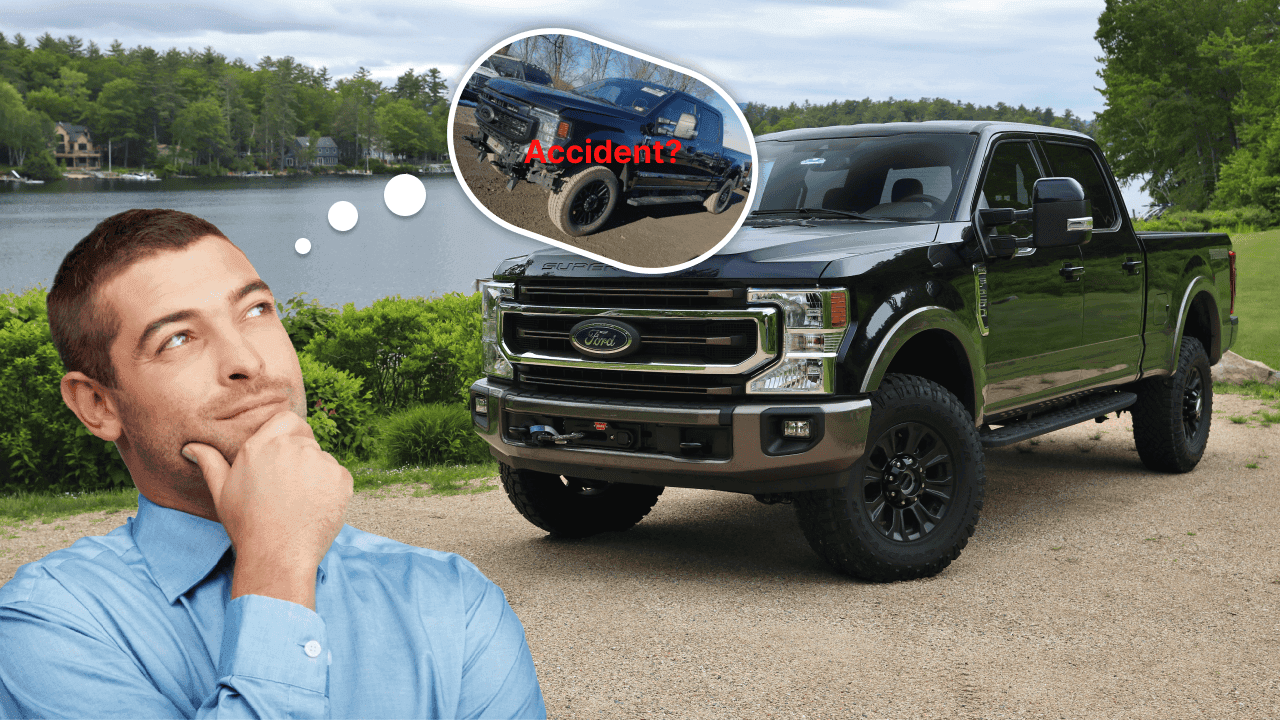

When Is a Car Considered Totaled?

Knowing the Totaled Car Meaning can aid you in making informed decisions after an accident.

The concept of Totaled Car Meaning plays a key role in how insurers evaluate damaged vehicles.

Understanding Totaled Car Meaning is crucial for both buyers and sellers in the car market.

Totaled Car Meaning can also vary by state, reflecting local regulations.

Every state has its own interpretation of Totaled Car Meaning based on specific laws.

A car is considered “totaled” when the cost of repairs exceeds the vehicle's value. Understanding Totaled Car Meaning helps clarify this process.

The Total Loss Threshold is an important factor in determining Totaled Car Meaning.

Understanding the Totaled Car Meaning helps clarify how total loss is determined by insurers.

Each example state illustrates the varying interpretations of Totaled Car Meaning.

When the repair estimate is above that amount or, occasionally, a stated percentage of it, they regard the car as a total loss.

Florida's definition of Totaled Car Meaning indicates that high repair costs can lead to a total loss.

Texas exemplifies a strict interpretation of Totaled Car Meaning with a high threshold.

North Carolina's criteria for Totaled Car Meaning ensures vehicles are thoroughly assessed.

California's Totaled Car Meaning reflects its unique formula for determining a total loss.

Understanding Totaled Car Meaning helps clarify your options after an accident.

Being aware of the Totaled Car Meaning can help you navigate post-accident procedures.

Recognizing Totaled Car Meaning can simplify the process of assessing vehicle damage.

For instance, if the car was worth $9,000 before a collision and the estimated cost to repair it after a collision is $10,500, the insurance company will almost always total it out since it won't be cost-effective to repair it.

Frame damage is a key factor in understanding Totaled Car Meaning.

The deployment of multiple airbags is often a significant indicator of Totaled Car Meaning.

They won't repair it but instead provide the ACV payout and deduct the deductible. This prevents insurance companies from paying out more than a car is worth.