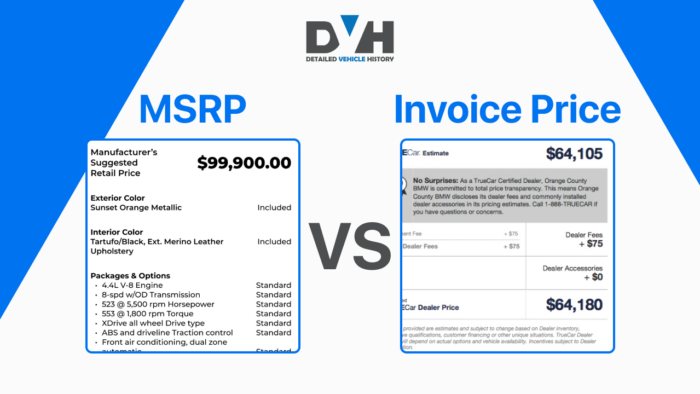

Buying a new car is a big investment to make. But just how much are you supposed to pay for a vehicle? I bet you’re wondering about the difference between the MSRP vs invoice price. These key pricing terms can help you get the best deal if you understand and know how to use them.

What is MSRP?

MSRP, or Manufacturer’s Suggested Retail Price, is the sticker price you see on a car window. It’s essentially a recommendation from the manufacturer just how much dealerships should sell the car for.

Note that it is just a recommended price, not the final price. This means that there is room for negotiations. Most dealers want you to think of it as the official price tag, but it should be the starting point of your negotiations.

Sometimes, car buyers pay way lower than the recommended price of a vehicle and some vehicles will be sold at the exact price or higher depending on demand and your negotiation skills. For example, when a car buyer comes into a dealership seeking a popular or limited model, or perhaps one in high demand, dealers can see this as a good opportunity to make lots of money.

How is the MSRP Set?

Generally, the manufacturer’s suggested retail price covers the following:

- The cost of production, including materials, labor, and overhead.

- Inclusion of additional features and higher trims.

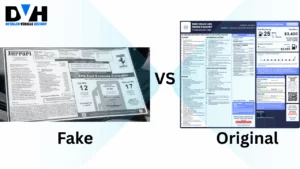

Knowing this price, especially during negotiations, can help you negotiate better. So where is this price found? You can find it on the window sticker on the windows of all new cars. If you can’t find one, you can also get a detailed window sticker by VIN with our tool.

What is the Dealer Invoice Price?

Now, let’s understand what the invoice price is. The invoice price, also referred to as the dealer price, is the amount that the dealer paid the manufacturer for the car. So, here’s how the whole process works.

Car dealers buy from manufacturers at the invoice price and they sell to make a profit. This price is usually the vehicle’s base price and dealers will not go below that during sales.

How is the invoice price set?

The invoice cost covers the following:

- The base price of the vehicle

- Additional costs the manufacturer meets, including advertising.

What’s the difference between MSRP and invoice price? When it’s time for negotiations the dealer would want to sell at the car’s MSRP but most times, they place the invoice price as the lowest they can allow. But the invoice price is the same amount paid for the car’s purchase, so how do dealers make profits? The Holdback price.

The Holdback price is a percentage of the recommended price or invoice that is paid to the dealer by the manufacturer after a car is sold. This means dealers can make money even if they sell at the lowest possible price. Now, you understand why you need to negotiate the invoice price vs MSRP before committing to any purchase.

What is the cost difference between the MSRP vs. Invoice Price?

There is no specific cost difference between the both prices as it varies based on popularity and demand. You can, however, expect at least a 20% difference between them.

In general, in-demand models have a smaller gap between the invoice and MSRP as dealers will likely charge more, while less popular ones might have a larger difference between them.

You must be careful and observant enough to pay between the invoice price and MSRP. The closer you can get to the invoice price, the better.

Is MSRP the final price?

No! The manufacturer’s suggested retail price is not usually the final price or out-the-door price. This list price is just the point of negotiation and you should aim to start negotiations at least 10 to 20% less than this price.

The final price of any vehicle in the US market is influenced by several factors including:

- Demand for the vehicle

- MSRP

- Dealer charges

- Registration fees

- Interest charges

- Taxes, and more.

If the vehicle you are interested in is a brand-new vehicle with high demand, you may end up paying the recommended price or even higher for that vehicle.

Can a car dealership charge more than MSRP?

Yes, dealerships can charge as much as they want. MSRP stands for the manufacturer’s suggested retail price and that’s all it is – suggested price and not maximum price. If a sophisticated, modern, and highly anticipated vehicle is launched with a limited inventory, dealers will seize the opportunity to make more money and will go above it.

What about dealer-installed options? These are not included in the sticker price and if a buyer needs some of those installations, they would have to pay higher.

Should I pay the MSRP for a used car?

If you are interested in a used car, you need to understand that it can no longer have the same value as it had when it was brand new. If you are buying a car and the dealer is trying to sell at the rate of the MSRP, you should not be afraid to walk out as you are most likely getting scammed.

For used vehicles, never use the list price as a point of negotiation.

Should I know the market value of a car?

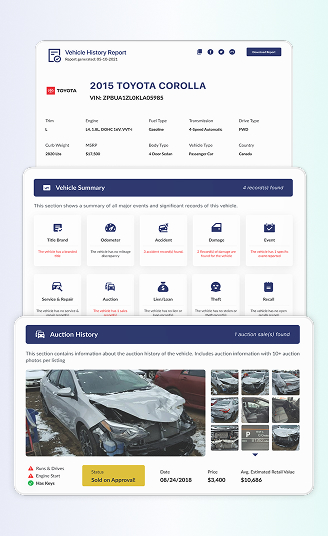

Yes, you should know the market value of a car before you even visit a dealership. The market value of a used or new vehicle is the average price car shoppers are paying for that vehicle based on the location.

This price doesn’t include taxes and other fees, but it gives you an idea of what you should budget for. New cars will typically have a market value that is between the invoice price and the sticker price, just somewhere in between.

A used or pre-owned car will most likely be more affordable based on the car’s average condition, age, model, and the average amount people are paying for it. You can get a VIN check at any time with our tool, to determine the market value of any vehicle before purchase.

Tips on how to get a fair price

Here are a few tips to remember during a car purchase:

- Research: Know the market value before visiting the dealership. You can use Detailed Vehicle History’s VIN check tool to get this value accurately.

- Understand Both Prices: Familiarize yourself with both values.

- Ask questions: Don’t be shy to ask questions. Make sure you understand every detail correctly. You can also ask to know the invoice price directly and determine where the negotiation starts.

- Negotiate: Be prepared to negotiate based on these figures.

- Additional Costs and Fees: Consider dealer fees, taxes, registration fees, and other costs.

- Explore other options: Before settling with one dealer, you need to check other dealerships too. Doing this will help you find the best possible price.

- Walk Away if Necessary: If the deal isn’t fair, don’t hesitate to walk away.

By following these tips and understanding the difference between MSRP vs invoice price, you’ll be well on your way to securing a new car at a fair price. You can also check the original msrp by vin for more accurate details about your vehicle’s value.

Frequently Asked Questions

The difference between the MSRP (Manufacturer Suggested Retail Price) and the car invoice price can vary depending on factors like demand and popularity of the vehicle. On average, you can expect at least a 20% difference between them.

It is just a suggested retail price, and there’s usually room for negotiating the price. You may end up paying significantly less for a slow-selling vehicle and on the other hand, not get so much discount on a high-demand vehicle.

No! It’s generally not ideal to pay over MSRP (Manufacturer’s Suggested Retail Price) for a car. It is a suggested price, and paying over it means you’re likely overpaying. However, in certain situations where there’s high demand or limited inventory, dealerships may charge more. So, it’s up to you to decide if paying over MSRP is worth it based on your preferences and the specific circumstances.