Transferring a car title in Texas is a step in legally documenting the change of vehicle ownership. Whether buying, selling, or inheriting a car, it is important to ensure the title is correctly transferred for legal reasons. While the process may seem daunting, understanding the steps makes the ownership transfer process smoother and easier.

Understanding the Car Title Transfer

A car title transfer in Texas legally changes vehicle ownership. The Texas DMV governs title transfer procedures, from gathering the necessary documentation to paying the required fees. Each step ensures a title transfer is done accurately and properly.

What to Do Before Transferring a Car Title

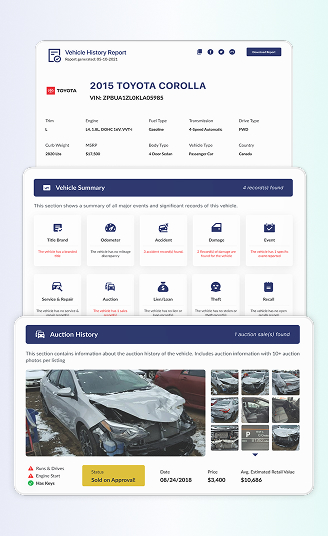

Before you purchase a used vehicle and transfer ownership, you can get a vehicle history report to see detailed information about the vehicle, including its past ownership, accident history, odometer readings, title status, and lien/loan records.

Documents Needed to Transfer the Vehicle Ownership

Before you submit the car transfer title request, you must provide the following documents to transfer car ownership in Texas.

Proof of Ownership

It is crucial to have the correct information on vehicle identification. Those who want to transfer ownership must provide a Texas driver’s license, as it is essential to match the name to the documents. Thus, the current title is the main proof of ownership. The seller must give this document to the buyer, ensuring all details are correct and both parties sign it.

If a lienholder is listed on the title, a lien release form from the lender is needed to complete the transfer.

Bill of Sale

While not required by Texas law, having the bill of sale beforehand can protect you and the seller from disputes. The bill of sale should include the sale information vehicle information like the year, make, and model.

Fill in the Form 130-U

Those applying for a Texas vehicle title or Registration must complete Form 130-U. This application includes detailed information about the vehicle, including the vital information of the vehicle and the parties involved. The seller and buyer must fill out and sign the form.

Submit the Documents and Pay the Fees

Once you provide the signed bill of sale, fill in the form with the needed information, and have proof of the car’s ownership, you may submit the documents to the Texas DMV and proceed with the request. Remember to recheck the documents to ensure no mistakes, including spelling, as this could disrupt the whole process.

In addition to submitting the needed documents, you must pay the fee for the vehicle ownership transfer. The fee often includes a base fee along with applicable taxes. The exact amount you must pay depends on the vehicle’s type and county, so you must verify the current fee with the Texas Department of Motor Vehicles.

Title Transfer Fees

For your convenience, here are the basic fees, generally following the list below. Make sure you do the check and recheck with the Texas DMV so everything is crystal clear.

- Title application: $28 or $33 (county dependent).

- Inspection fee (state portion): Up to $30.75.

- Your inspection station will charge additional service fees upon inspection.

- Local and county fees: $31.50 (maximum amount)

- Insurance verification fee: $1.

- Automation fee: $1.

Easy Steps to Do a Car Transfer in Texas

Transferring a car title in Texas doesn’t need to be a hurdle. We’ve simplified the process for you. You may follow the steps below:

Getting the Title Transfer Form

You must get Form 130-U, the Texas Title and Registration Application. You can download it from the Texas DMV website or pick it up at a local county tax officer. The seller and buyer must sign the form before proceeding with the process.

Finalizing the Transfer at a County Office

Both parties should visit a county tax office with the necessary documents to complete the transfer. These include the completed Form 130-U, the current vehicle title, and valid identification.

A lien release document is required if a lien is on the title. Buyers must also pay title transfer fees, which vary by location and vehicle type. Checking with the TxDMV or local tax office ensures the correct payment amount.

Online Title Transfer Option

Some title transfers can be completed online through the TxDMV’s electronic system. The buyer and seller must create accounts and submit the necessary forms digitally. However, not all vehicles qualify for this option, so checking eligibility on the TxDMV website is important. Online transfers allow users to pay fees electronically, making the process quicker and avoiding in-person visits.

When Can You Transfer a Car Title in Texas?

A car title transfer in Texas is needed in several situations. Here are the most common reasons:

- Selling a Car – The title must be transferred to the new owner, whether privately or through a dealer.

- Gifting a Vehicle – If you give a car to a family member or someone else, the title must be transferred to their name.

- Inheritance – When inheriting a car, the title must be updated. The process depends on whether the estate requires probate.

- Paying Off a Loan: Once a car loan is fully paid off, the lienholder releases their claim, allowing you to update the title.

- Moving to Texas: If you bring a car from another state, you must transfer its title to Texas.

- Fixing a Title Error – If the title has incorrect details, you can apply for a correction, often without extra fees.

Although transferring a car title is easy, it’s an important step you need to take that will protect you from car ownership issues.

Frequently Asked Questions About Transferring a Car Title in Texas

To transfer the car title to another Texas family member, you must complete several steps according to the Texas DMV guidelines. Gather the necessary documents, including the vehicle ownership proof, Form 130-U, and lien release (if available).

If you gift the vehicle, you must complete the Affidavit of Motor Vehicle Gift Transfer and submit it to the county tax office along with the required fee, including the $10 tax. The recipient must provide proof of insurance and may need to have the vehicle inspected.

In Texas, the title application costs $33, and buyers pay a 6.25% sales tax on the purchase price. Other charges may include local taxes, a lien transfer fee, and inspection fees. Late fees apply if the transfer is not completed on time.

If the title is not transferred within 30 days, there is a $25 penalty, plus $25 for each extra month. The county tax office and the Texas DMV cannot waive these fees, so they cannot be reduced or removed.

No, Texas requires a vehicle inspection before the title transfer can be done. Ensure your vehicle passes the inspection and obtains the Vehicle Inspection Report (VIR), which has to be presented during the title transfer process.