What is MSRP?

How is the MSRP Set?

- 1.The cost of production, including materials, labor, and overhead.

- 2.Inclusion of additional features and higher trims.

What is the Dealer Invoice Price?

How is the invoice price set?

- 1.The base price of the vehicle

- 2.Additional costs the manufacturer meets, including advertising.

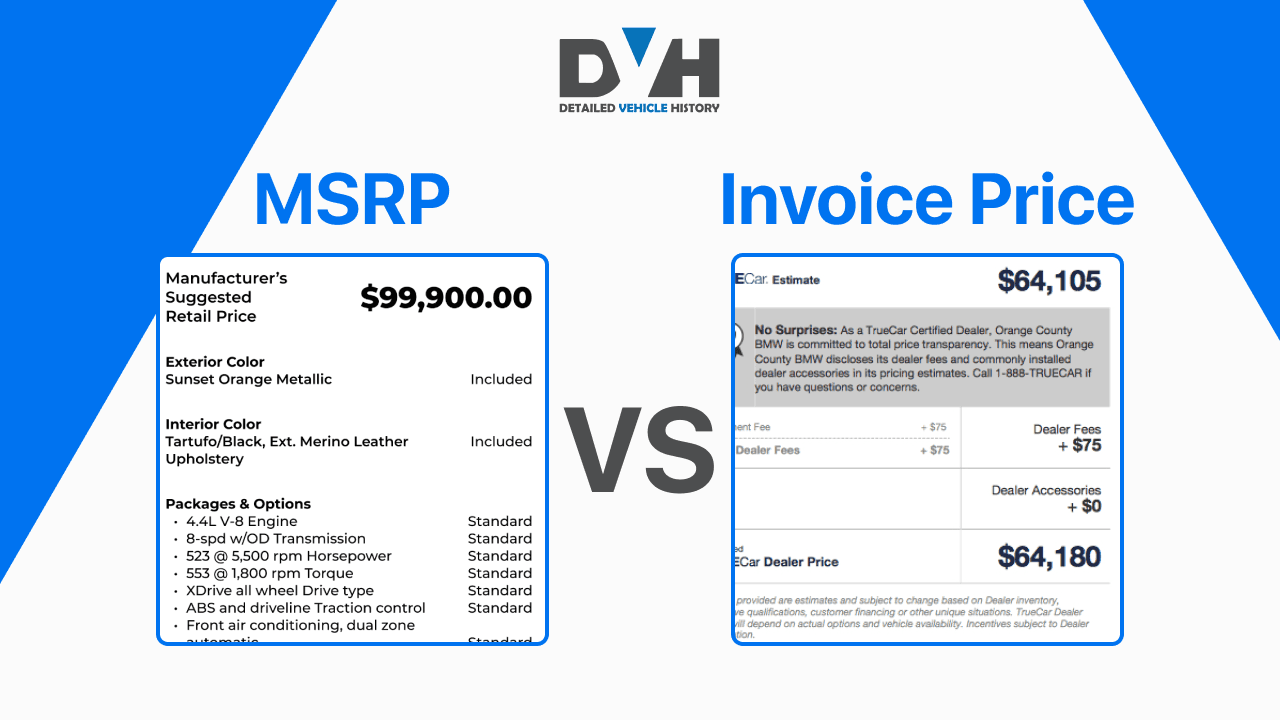

What is the cost difference between the MSRP vs. Invoice Price?

Is MSRP the final price?

- 1.Demand for the vehicle

- 2.MSRP

- 3.Dealer charges

- 4.Registration fees

- 5.Interest charges

- 6.Taxes, and more.

Can a car dealership charge more than MSRP?

Should I pay the MSRP for a used car?

Should I know the market value of a car?

Tips on how to get a fair price

- 1.Research: Know the market value before visiting the dealership. You can use Detailed Vehicle History's VIN check tool to get this value accurately.

- 2.Understand Both Prices: Familiarize yourself with both values.

- 3.Ask questions: Don't be shy to ask questions. Make sure you understand every detail correctly. You can also ask to know the invoice price directly and determine where the negotiation starts.

- 4.Negotiate: Be prepared to negotiate based on these figures.

- 5.

- 6.Explore other options: Before settling with one dealer, you need to check other dealerships too. Doing this will help you find the best possible price.

- 7.Walk Away if Necessary: If the deal isn't fair, don't hesitate to walk away.