Key takeaways:

- Title loans involve high-interest rates and the risk of losing your vehicle if you default.

- Personal loans, credit union loans, or even credit card cash advances can offer better terms than title loans.

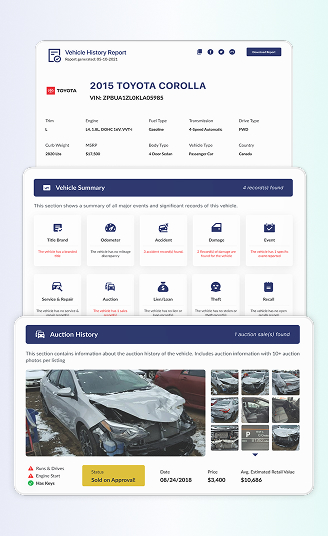

- Get the vehicle history report to examine if the car has any kind of unpaid loan, check the complete specifications, and past records like accidents, recalls, and auctions.

A title loan is a short-term loan that uses your car as collateral. You temporarily hand over the vehicle’s title to the lender in exchange for quick cash, and must be repaid, often within 15 to 30 days, along with a high interest rate.

What is a Title Loan?

A title loan is a short-term solution with the highest loan amount secured by your vehicle’s title. This method allows you to borrow up to 25% to 50% while keeping your car. In a car title loan, you give the lender your vehicle’s title as collateral, meaning that if you fail to repay the loan and its substantial fees by the deadline, the lender has the right to repossess and sell your car to settle the debt.

A title loan is significantly different compared to a traditional bank loan, because the title loan uses your vehicle as collateral for a short-term, high-interest rate loan, and sometimes with no prior credit check. Whereas a traditional bank loan has stricter rules compared to a title loan.

Title Loan Application Process

The title loan application process is designed to check the borrower’s eligibility and the value of the vehicle used as collateral. Different lender has different steps; however, the steps to apply for the loan are easier compared to the bank.

Here are the steps you need to follow to apply for the title loan.

Step 1: Fill Out the Application

Like the usual application method, you will need to fill out an application form. In the form, you should write down personal information (name, contact, and address), and the vehicle’s details (year, make, model).

Step 2: Submit the Documents

The vehicle title is required and must show that there are no existing liens. Proof of identity, residence, and income is also needed so the lender can assess financial stability. You will need to submit these documents along with the application form.

Step 3: Vehicle Value Inspection

The appraisal considers factors like the car’s condition, mileage, and demand. This step helps the lender decide how much money can be loaned, and it will depend on the vehicle’s market value.

Step 4: Loan Assessment

Once the appraisal and documents are complete, the lender evaluates the application. While some lenders check credit scores, many focus mostly on the vehicle’s value and the borrower’s ability to repay the loan.

Step 5: Loan Offer and Agreement

If approved, the lender will offer the loan and show the amount, interest rate, and repayment terms. Borrowers should review all terms carefully. Once accepted, a lien is placed on the vehicle title until the loan is fully repaid.

Step 6: Funding

After signing the agreement, the funds will be given or transferred to the borrower. Borrowers may receive money via direct deposit, check, or cash, depending on the lender.

Example of a Title Loan Calculation

If you take out a 30-day car title loan for $1,000 and the lender charges a 25% fee, here’s how it works:

- Loan Amount: $1,000

- Fee: 25%, $1000 x 0.25 = $250

- Total Repayment: $1,000 (loan) + $250 (fee) = $1,250

In this case, you would need to repay $1,250 by the due date, probably around 30 days.

Read also: What Does A Clean Title Mean? All You Need To Know!

Types of Title Loans

Title loans come in different forms, depending on factors such as the collateral used, repayment method, and loan amount. Understanding the types available can help borrowers make informed decisions and weigh potential risks.

Vehicle Title Loans

The most common type is a vehicle title loan. Borrowers use cars, trucks, motorcycles, or even boats as collateral. Typically, borrowers can receive 25% to 50% of the vehicle’s value, with loans ranging from $100 to $10,000.

Single-Payment Title Loans

Single-payment title loans require repayment of the full loan amount, plus interest and fees, in one lump sum by a set due date, usually 15 to 30 days. These loans often have very high interest rates, sometimes exceeding 300% APR.

Instalment Title Loans

Some states offer installment title loans, allowing borrowers to pay off the loan in multiple smaller payments over time. This type of instalment loan helps borrowers to be more manageable, even though the interest rate might still be high.

Equipment Title Loans

Title loans are not limited to vehicles. Businesses can use heavy machinery or other equipment as collateral to secure funding. Equipment title loans are typically used to cover operational expenses or purchase new equipment, giving companies quick access to cash without selling assets.

Some states ban them altogether, while others limit loan amounts, interest rates, or terms. Understanding local regulations is crucial to know what types of loans are offered and their risks.

Requirements for Getting a Title Loan

To be eligible for a title loan, you will need a loan-free vehicle, an ID card, proof of income, and, in most cases, proof of vehicle insurance. The lender will then hold your vehicle as collateral for a short-term and high-interest loan.

- Lien-Free Vehicle Title: The title must show that you fully own the vehicle with no outstanding loans or liens. Run a lien check by VIN to ensure that the vehicle is clear from any kind of financial responsibility.

- Government-Issued Photo ID: A valid ID, such as a driver’s license or passport, to confirm your identity and age.

- Proof of Income: Documents like pay stubs or bank statements to show your ability to repay the loan.

- Proof of Insurance: Required to show your vehicle is insured, as it serves as collateral for the loan.

- Proof of Address: A document that shows where you reside, such as a utility bill.

- Vehicle Registration: Must be the latest date of registration and written under your name.

Vehicle & Personal Details

- Vehicle Ownership: You must own the vehicle, and the title must be in your name.

- Vehicle Inspection: The lender will inspect your car’s condition, make, model, mileage, and value to determine the loan amount.

- Residency: You must be a resident of the state where you’re applying for the loan. If you live in California, you cannot apply for a title in Florida.

- Age: The borrower must be at least 18 years old to apply.

Read also: All Types of Car Titles Explained

Pros and Cons of Title Loans

Title loans can offer quick financial relief, particularly for those with poor credit, but they come with notable risks and high costs. Generally, title loans are seen as a last resort due to their short repayment terms and steep fees.

Pros of Title Loans

- Quick Access to Cash: The application process is fast, and you could receive the money on the same day. Ideal for those who need an emergency fund.

- Easy Qualification: The approval process is based on your vehicle’s value and proof of ownership. The lender will not check your credit score; the title loan is sometimes a choice for those who have a poor credit score or no credit history.

- No Credit Check: Most lenders don’t require a credit check, so applying won’t impact your credit score.

- Keep Your Car: You can continue driving your car while making payments, as long as you regularly pay the loan until it is paid off.

- Higher Loan Amounts: Since the loan is secured by your car, you can typically borrow a larger sum, often up to 50% of the car’s value, compared to unsecured loans like payday loans.

Cons of Title Loans

- Risk of Losing Your Vehicle: The most significant risk is that if you default on the loan, the lender can repossess and sell your car to recover the debt.

- High Costs: Title loans come with extremely high interest rates, often around 300% APR or a monthly finance charge of 25%, making them an expensive option.

- Short Repayment Terms: Title loans usually come with short repayment periods, often 15 to 30 days, which can be challenging to meet, especially when factoring in the fees.

- Debt Cycle: If you’re unable to repay the loan, many lenders allow you to “roll over” the loan, adding more fees and interest. This can lead to a cycle of debt where you continue paying fees but don’t make progress on the principal loan.

- No Credit Building: Since lenders don’t typically report payments to credit bureaus, making timely payments on a title loan won’t help improve your credit score.

- Hidden Fees: Additional fees, such as processing or late fees, may be charged, quickly increasing the total amount you owe.

- Limited Availability: Many states have banned or severely restricted title loans due to concerns about predatory lending practices.

Safer Alternatives to Title Loans

High-cost vehicle title lending is currently prohibited across 33 U.S. states and the District of Columbia. There are several safe and more reliable options available than a title loan, which relies on your vehicle as collateral and has a big risk of repossession.

The best for you will depend on several factors, such as your credit score, financial needs, and how fast you need the money.

- Credit Union Loans: Many federal credit unions offer Payday Alternative Loans (PALs) ranging from $200 to $2,000. The maximum rates for the credit union loans are 28% and you can request to extend the repayment terms for a year.

- Personal Loans from Banks or Online Lenders: Personal instalment loans often come with larger loan amounts, lower interest rates, and fixed repayment terms compared to title loans.

- Small Loans from Community Banks: Local banks can sometimes offer smaller loans with more favourable terms than larger, national banks, providing a more manageable repayment plan.

- Credit Card Cash Advances: A credit card cash advance offers quick access to funds with interest rates typically lower than title loans. However, please note that you will be required to pay the loan immediately before the rates increase.

- Registration Loans: In certain states, registration loans use your vehicle’s registration as collateral, rather than the title. Unlike a title loan, the lender cannot repossess your vehicle if you cannot pay the loan.

Is a Title Loan a Good Idea?

A title loan is not considered a good idea by financial experts. Hence, title loans should be considered as a last resort due to their risky schema. While the title loan offers a quick cash solution without checking the credit score first, it’s always guaranteed that it will definitely come with a great risk.

Before opting for a title loan, it is better to explore safer alternatives. If you’re using your car as collateral or buying a used vehicle, use a lien check tool to ensure there are no existing unpaid liens or loans you should be concerned about.

What People Inquire About Title Loans?

Is it a good idea to get a title loan?

No, it is generally not a good idea to get a title loan because the extremely high costs and risk of losing your vehicle often outweigh the benefits, making it safer to explore more affordable options like a personal loan or credit card first

Is it smart to use my car as collateral?

When you use your car as collateral, it could be considered a smart move–only if you own the car in your name.

What disqualified you for a title loan?

You can be disqualified for a title loan if your vehicle is too old or has high mileage. Or if you do not have sufficient income to afford the loan.

What happens if the title loan is not paid?

If a title loan is not paid, the lender has the right to repossess and sell the vehicle to cover the loan. If the amount of it does not exceed the loan, you will be responsible for paying the remaining balance.