South Dakota Bill of Sale for Cars, Trucks, Trailers, and Boats

Buying or selling a car in South Dakota? You’ll need more than just a handshake and a “good luck” text. A South Dakota bill of sale is your safety net – proof that the deal happened, who was involved, and what changed hands.

What is a South Dakota Bill of Sale?

A South Dakota bill of sale is a legal document that officially records the transfer of ownership for personal property, which includes items like vehicles, boats, or equipment. The document must include important details such as information about the buyer and seller, a description of the item, and the final sale price.

For vehicles, this bill of sale is a required document that the buyer needs to register the car and transfer the title. The state often requires both the buyer and seller to complete a specific form, which is Form 1025.

Why Sellers and Buyers Need a Bill of Sale in South Dakota?

For Seller

- Serves as legal proof that the vehicle was sold.

- Releases the seller from future liability, such as fines or accidents.

- Shows when and to whom the vehicle was sold.

- Protects against disputes or false claims after the sale.

- Keeps a clear record for tax or legal purposes.

For Buyers

- Confirms legal ownership of the vehicle.

- Provides a record of payment and sale details.

- Helps with DMV registration and insurance.

- Useful for tax documentation and proof of purchase.

- Protects against ownership or condition disputes.

Types of South Dakota Bill of Sale

South Dakota does not have a specific type of bill of sale as a legally binding document for different items. A simple written agreement signed by both the buyer and seller can serve as a valid bill of sale.

- General Bill of Sale: A simple document used for any type of item, such as furniture, tools, or equipment.

- Motor Vehicle Bill of Sale: Used for selling cars, motorcycles, or other motor vehicles. It confirms the transfer of ownership and is often used with the vehicle title.

- Boat Bill of Sale: Used when buying or selling a watercraft, providing a written record of the sale and ownership change.

- Aircraft Bill of Sale: Needed when transferring ownership of an aircraft.

- Custom Bill of Sale: A personalised form used for other valuable property, like trailers or heavy machinery, as long as both parties sign it.

What’s Written in the South Dakota Bill of Sale?

A bill of sale contains everything about the transaction, buyer, and seller. This includes:

- Buyer & Seller Info: Full names, addresses, and contact details

- Vehicle Details: Make, model, year, VIN (double-check this!), and South Dakota license plate lookup information

- Sale Price: The agreed amount, no “gift” loopholes unless you like tax headaches

- Date of Sale: When ownership is officially transferred

- Odometer Reading: Required to prevent fraud

- Signatures: Both parties must sign, and a notary is recommended

How to Register a Vehicle in South Dakota

To register a vehicle in South Dakota (SD), you must first establish residency and then visit your local county treasurer’s office to complete the application process.

Establish Residency and Address

Before you can register, you need to set up your legal presence in the state:

- Get a South Dakota Address: You must establish a permanent SD address. (Many new residents utilise a commercial mail forwarding service for this purpose).

- Obtain a South Dakota Driver’s License: You must surrender your out-of-state license to get an SD driver’s license or ID.

Gather Necessary Documents

Collect the following items for your application:

- Title/Certificate: The original out-of-state title or the Manufacturer’s Certificate of Origin.

- Completed Application: The official “Motor Vehicle and Boat Title & Registration Application”.

- Proof of Identity: Your South Dakota driver’s license or ID for each owner.

- SSN and Business Info: A copy of your Social Security number (and FEIN if registering as a business).

- Proof of Insurance: Documentation showing current financial responsibility (insurance).

- Bill of Sale: Required to prove the purchase price and whether sales tax was paid in another state.

Submit Your Application and Pay Taxes

- Visit the Treasurer’s Office: Go to your local county treasurer’s office—this is the only place to complete the initial registration.

- Pay Fees and Taxes: Be prepared to pay the following:

- 4% Sales Tax: You must pay a 4% sales tax on the vehicle’s purchase price. (If you paid tax in another state, you must bring proof, like the bill of sale, to receive credit and avoid paying the tax again).

- Titling, Registration, and Lien Notation fees.

4. Receive Plates and Tags

After successful registration, you will be given temporary tags immediately. Your permanent license plates will be mailed to your South Dakota address shortly thereafter.

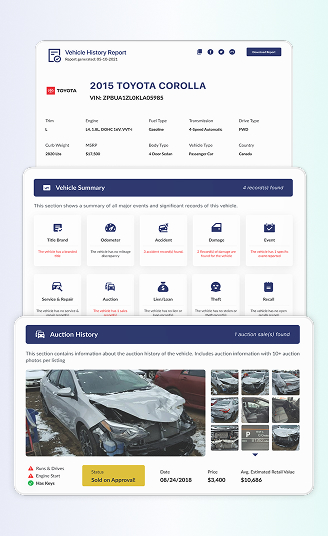

South Dakota VIN Check – Verify Vehicle History Before You Buy

Plan to buy a used vehicle? Be sure to check the VIN and get the report before you decide to purchase the vehicle. Check the specifications and the records, like auction, recalls, past usage, and more.

Mileage History

Title Brand

Ownership History

Warranty Status

Sales History

Salvage Title

Usage History

Repair Cost

Auction History

Hail Damage

Ownership Duration

Recalls History

Accident History

Flood Damage

Lien & Loans

Maintenance Schedule

Get a Vehicle Bill of Sale by State

Each state has its own requirements for an auto bill of sale. Click below to find the template for your state!

South Dakota Bill of Sale FAQs

Is a bill of sale required to register a vehicle in South Dakota?

Not always, but it’s highly recommended, especially for private sales. While the state may not always require it, having a bill of sale can help verify ownership and provide a record of the transaction if any issues arise later.

Can I handwrite a bill of sale?

Yes, but it must include all necessary details, such as the buyer and seller’s information, vehicle description, price, and date of sale. It should also be legible to avoid any confusion or disputes.

What if the seller doesn’t provide a title?

Walk away. A missing title is a major red flag and could indicate issues like unpaid loans, theft, or hidden liens. Always ensure the seller provides a valid, signed title before completing the purchase.

Does a bill of sale need to be notarized in South Dakota?

No, a bill of sale does not need to be notarized to be legally binding in South Dakota. It is valid as long as the people involved have signed it. However, having the document notarized can add an extra layer of protection, which helps it to be accepted in court if there is a disagreement or dispute.

Can I register a car online in South Dakota?

Yes, you can register your car online in South Dakota to renew your registration and buy new plates. The state has an online portal that offers these services. However, if you are titling and registering a new vehicle, you will usually need to visit your local county treasurer’s office.