Military personnel on active duty, veterans, and their family members deserve special treatment, don’t they?

They put their lives at stake to defend and protect the country, and we are about to consider some of the best car insurance for military members.

The insurance companies to be discussed have proved helpful to military members and their families by helping them to save extra money.

Before we learn more about the insurance companies that provide good insurance programs for military members let us x-ray auto insurance.

Understanding Auto Insurance

Auto insurance helps you to cover the expenses usually incurred when your vehicle is involved in an auto crash. Insurance policies may also assist you in covering the cost of injuries sustained during such collisions.

Most countries and states in the US require minimum insurance as a means of protecting vehicles on the road should an accident occur.

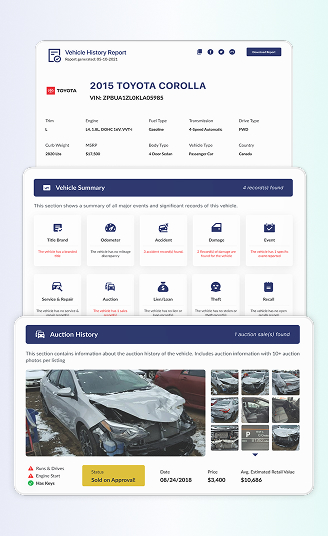

It is worth noting that Detailed Vehicle History, uses top insurance companies’ databases when sourcing data used in developing a detailed vehicle history report.

Here is some insurance that provides discounts and other incentives as a means of appreciating the services rendered by servicemen.

1. USAA

USAA is an insurance company that was founded in the year 1922, with the primary purpose of providing automotive insurance for members of the US army, this includes those in active service alongside family member who qualifies and veterans.

Over the years USAA has been acknowledged for its low rates and discounts offered to military members.

2.Geico

This company provides insurance services to military members and civilians as well, however, they are known to provide some valuable discounts on military auto insurance.

Geico gives a 15% premium reduction for those who are in active service

3. Esurance

Esurance is known for granting deployed servicemen the privilege to cancel or suspend their car insurance in the meantime.

Whenever military member wants to reinstitute their insurance coverage they can do this without incurring any form of penalty. Why is this beneficial? It is beneficial because most companies only provide good coverage for individuals who constantly renew or maintain their insurance package.

Why should military member insure their vehicle?

Here are some obvious reasons why getting vehicle insurance is important:

It may be unlawful not to have insurance

In some countries around the world, auto insurance is required by law. Hence a law-abiding individual must obtain vehicle insurance.

It is important to find out about the minimum insurance package permissible according to the law and adhere to that set standard this will help one to escape the penalty associated with negligence.

Auto Insurance can cover damages caused by natural disasters

Most insurance packages, especially comprehensive ones, usually provide coverage for harmful consequences of natural disasters, such as wildfires, hail, ice, storms, and other forms of unforeseen occurrences which damaged a vehicle.

Car insurance can cover you when you cause an accident

Every road user can intentionally or unintentionally cause an accident at one point or the other. Insurance can cover you even when it is obvious that the fault is all yours. In this case, collision insurance or a personal injury protection package can offer the surest possible coverage.

How Detailed Vehicle History(DVH) Utilizes Insurance Data

Insurance data plays a vital role in the development of detailed vehicle history reports for used vehicles. For instance when a vehicle is badly damaged the insurance company can rebrand such a vehicle giving it a new title, such as salvage/total loss.

This new title will affect the value of the vehicle during re-sale and help interested buyers to know what has happened to the vehicle in past.

Detailed Vehicle History, developed a powerful system that accesses up-to-date information about any used vehicle, this tool has helped so many used car buyers to make sound and inform decisions and escape what many refer to as “Buyer’s Remorse”.

How to gain access to Detailed Vehicle History’s insurance data

To access the insurance records of any used vehicle you can use the VIN lookup tool, this can be achieved by following the steps outlined below:

- Visit the VIN lookup tool page

- Enter your VIN and other required details

- Click on check VIN

The report generated will include the insurance records for the vehicle and many more details.