Check Car Insurance by VIN Number Lookup for Auto Insurance Coverage

Having access to insurance records on a vehicle protects car buyers and sellers and helps them make the right decisions in the used car market. Check car insurance by VIN number today to access auto theft records or claims, total loss records, damage records and more.

Having access to insurance records on a vehicle protects car buyers and sellers and helps them make the right decisions in the used car market. Check car insurance by VIN number today to access auto theft records or claims, total loss records, damage records and more.

What is Car Insurance?

Over the years, car insurance has played a major role in protecting car buyers and sellers during sales. With insurance, car buyers can protect their vehicles from unforeseen risks in the future and keep their investments safe. Car sellers can also ensure their vehicles are protected until ownership is transferred.

Importance of Auto Insurance Coverage

Here are some reasons why car insurance is important:

Legal Requirement

Car insurance is a legal requirement in many places. It ensures that drivers can cover the costs of damages or injuries resulting from accidents they may cause.

Financial Protection

Car insurance provides financial protection against various risks, including accidents, theft, vandalism, and natural disasters.

Peace of Mind

Knowing that you’re protected by car insurance offers peace of mind while driving. It allows you to focus on the road without worrying about potential financial burdens in case of accidents or other incidents.

Asset Protection

For many people, a car is one of their most valuable assets. Car insurance helps protect this investment by covering repair costs or providing compensation if the vehicle is damaged or totaled.

Liability Coverage

Car insurance also includes liability coverage, which pays for damages or injuries you cause to others in an accident. This coverage is essential for protecting your financial assets if you are sued for damages.

Insurance ensures that you and your vehicle are in good hands and safe at all times. For car buyers, aside from having access to insurance information, it’s essential to check car insurance by VIN number to access vehicle history, including auto theft claims, total loss records, and more.

Auto Insurance Information Accessible With a VIN Check

A lookup gives a better view of a vehicle’s history, which helps in getting more accurate premiums and spotting insurance claims (accident claims or damage claims), which is done using the Vehicle Identification Number only.

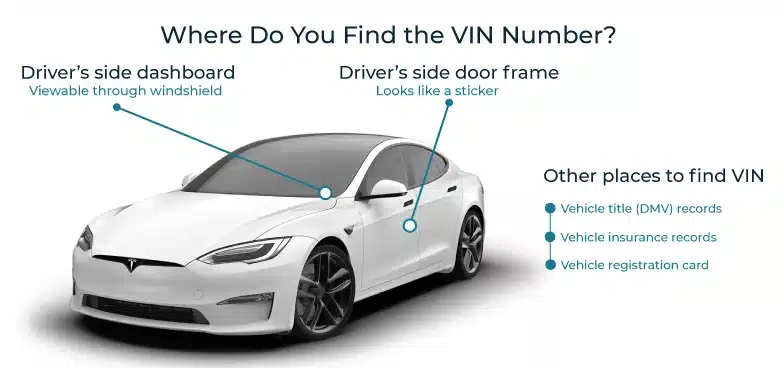

A VIN (Vehicle Identification Number) is a unique code assigned to each motor vehicle. It could be 17 characters or between 5 and 13 digits in classic vehicles. The VIN serves as a means of identification, providing essential information about the car’s make, model, year, and more.

Where is the VIN found?

You can typically find the VIN on the:

You can typically find the VIN on the:

- Dashboard

- Driver's side door

- Engine block

- Vehicle registration documents.

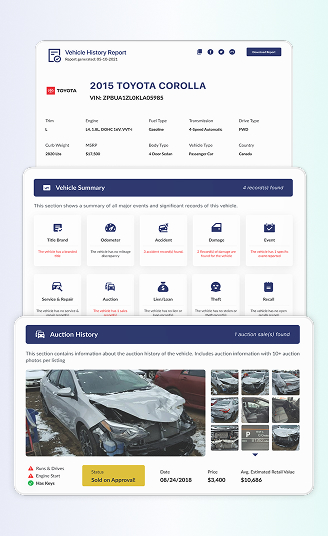

When you perform an insurance VIN check with our tool, you gain access to crucial information about a vehicle’s insurance history and status. This includes:

Insurance Claims History

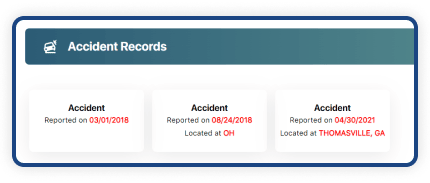

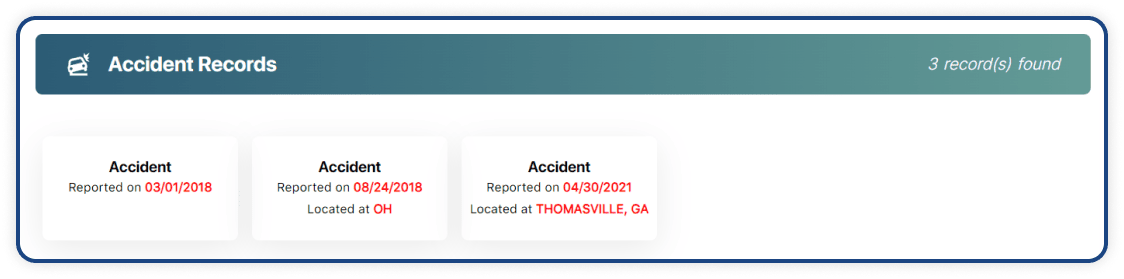

Checking a vehicle’s insurance history by its VIN can reveal its insurance claims history, including past accidents or damage claims filed with insurance companies. This information helps potential buyers assess the vehicle’s reliability and possible risks.

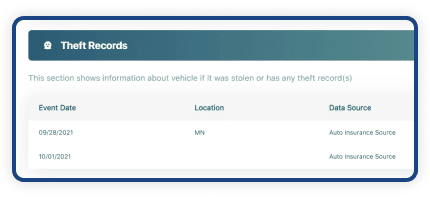

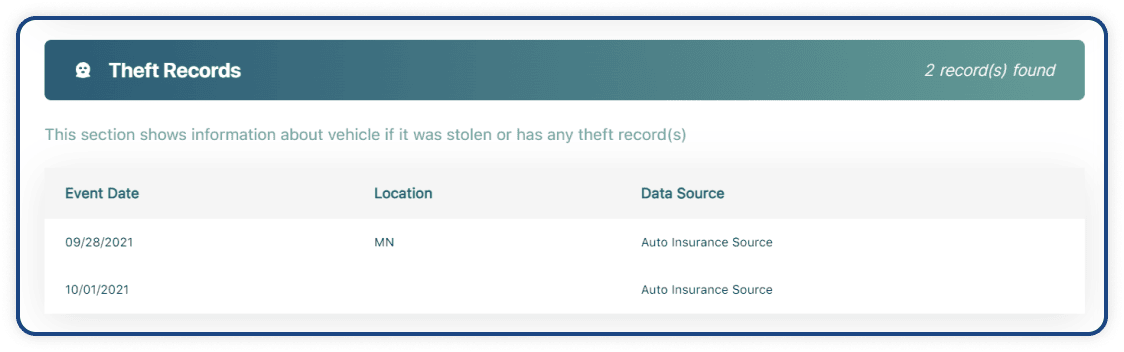

Theft Records

Using the VIN, anyone can find out if a vehicle has been reported stolen or has a history of theft-related incidents. This is crucial for buyers concerned about purchasing stolen cars.

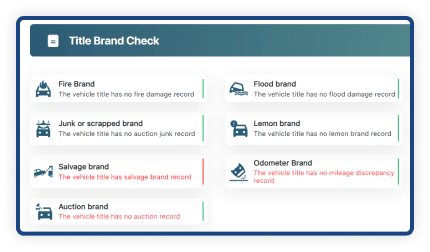

Total Loss Records

With VIN checks, it is easier to identify if an insurance company has declared the vehicle a total loss due to severe damage or accidents in the past. This information helps buyers understand the vehicle’s condition and potential resale value.

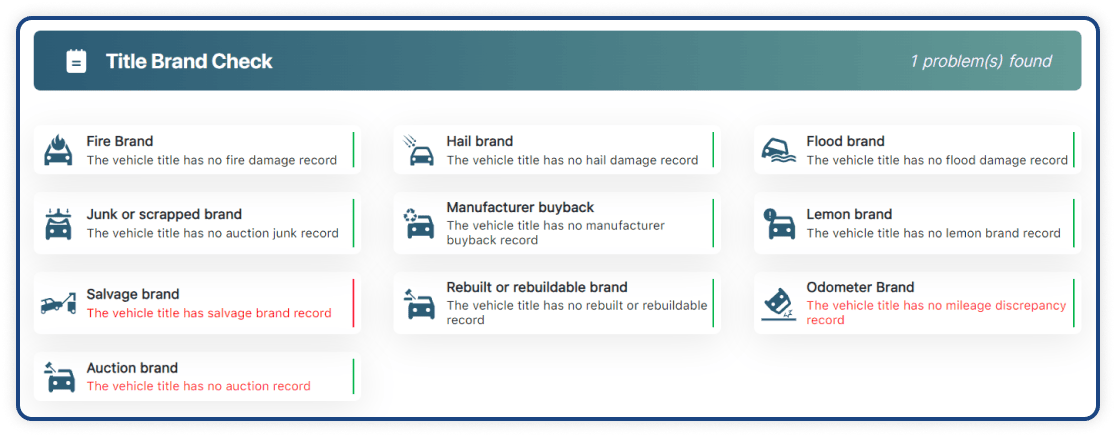

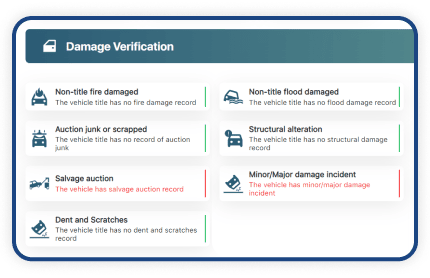

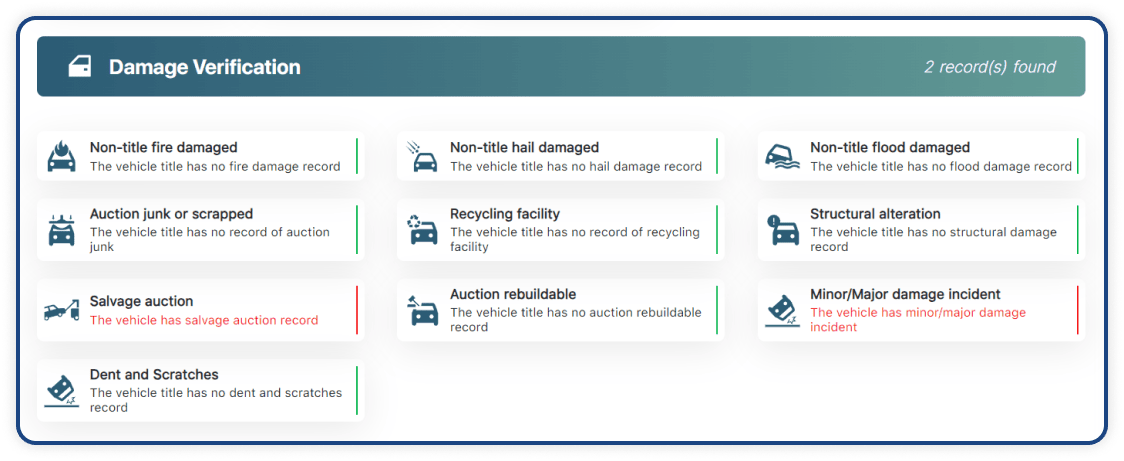

Damage History

A check may also provide insights into the vehicle’s damage history, including previous repairs or structural damage. Understanding the vehicle’s past can help buyers make informed decisions about its reliability and future maintenance needs.

Other records accessible with our VIN check tool are:

- Ownership History

- Vehicle specifications

- Sales history

- Auction history

- Mileage records

- Lien and loan records

- Market value

- Maintenance schedules

- Pending recalls, and more.

Our car insurance lookup tool is the easiest way to ensure a safe car purchase or sale, much simpler and detailed than using the National Insurance Crime Bureau (NICB) or other VIN check websites. Don’t complete a purchase without checking if a vehicle has hidden records!

Save time and get detailed reports with our Mobile App!

On the road? At a dealership? Save time and enjoy offline free VIN decoding with the VIN decoder and Vehicle History application. Available in both Android and iOS versions, you can easily scan VINs and license plates. Save time and minimize typing errors.

Get started with the mobile app today!

Why look up car insurance information?

Some reasons why you need to check vehicle history records are:

1. For Accurate Insurance Quotes

For insurance companies and car buyers, the most accurate method to assess a vehicle’s condition is to check its history with a report. A report makes a vehicle’s history and condition easy to understand, and accurate premiums are provided.

2. To Determine Risk Associated with the Vehicle

A VIN check reveals valuable insights into any car’s past, including its accident history, damage records, and theft reports. With this information, insurers can easily evaluate the vehicle’s likelihood of future claims and adjust insurance premiums accordingly.

Knowing the risk level associated with a vehicle allows buyers to make informed decisions about purchasing insurance and understand potential future costs.

3. To Verify if a Car Has Been in an Accident or Stolen

Nobody wants to end up with a stolen or damaged car. A VIN check clears every doubt and points car buyers in the right direction. With a report, buyers and insurers can review information on previous accidents or stolen records.

Now you know why and when you should carry out a check!

How Do I Check a VIN Number?

To get a VIN check for any vehicle, simply follow the steps below:

- Locate the VIN on your vehicle

- Navigate to the form on this page

- Enter the VIN and fill out the form

- Select “Check VIN.”

- Receive and review your vehicle history report.

You will instantly receive the vehicle history report. You can never go wrong with a VIN check. Search any VIN now.

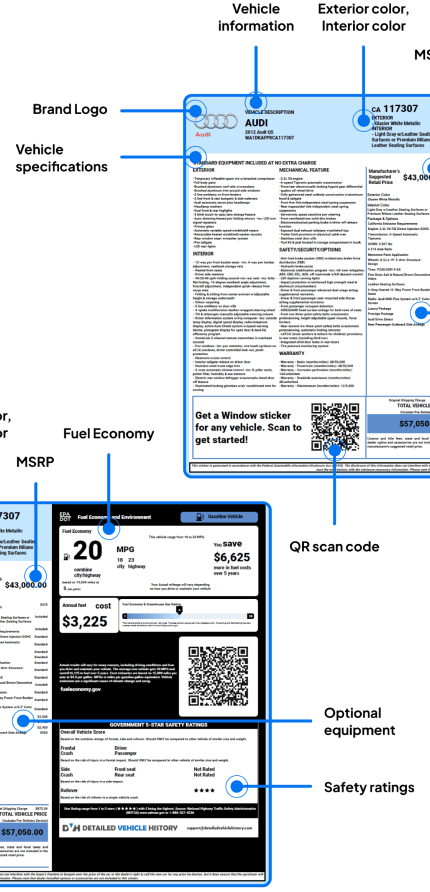

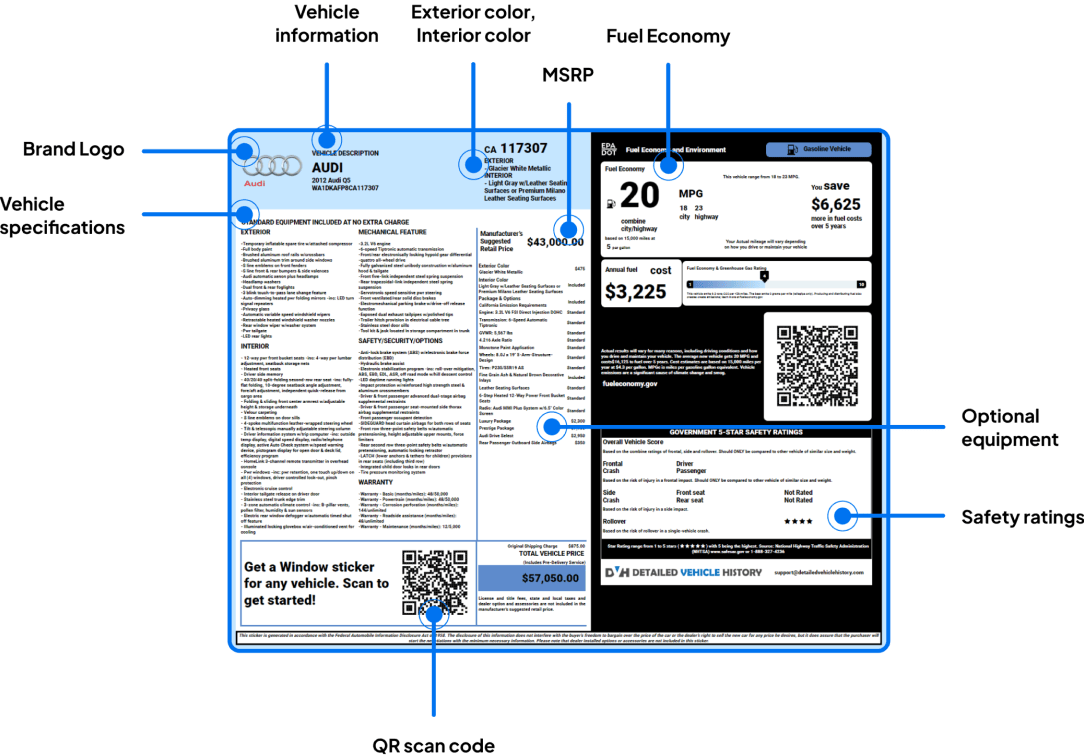

Get a Window Sticker

While checking out our VIN lookup tool, a window sticker is also important for car buyers and sellers. A window sticker provides a detailed list of any vehicle’s standard equipment, optional packages, MSRP, fuel economy, exterior and interior colors, and lots more vehicle specifications.

Insights into US Car Insurance Trends

- Forbes data indicate that the national average cost for car insurance in the United States is approximately $2,150 annually for full coverage.

- According to a Forbes report, the cost of auto insurance increased substantially by 63.8% between 2014 and 2023.

- The rates for full coverage vary widely among insurers. For full coverage, the average annual cost ranges from $1,412 with USAA to $3,233 with Mercury, as reported by Forbes.

- According to Forbes, minimum coverage rates span from $241 per year with Erie and Mercury to $892 per year with Safe Auto.

- Insurance Information Institute noted a significant uptick in vehicle thefts in the United States in 2022. Over 1 million vehicles were stolen in the United States, marking the first time this figure has surpassed a million since 2008.

- The NICB reports that the states with the highest number of reported stolen vehicles were California and Texas, while Illinois experienced the largest increase, estimated at 35% between 2021 and 2022.

- Vehicle theft data analyzed by the National Insurance Crime Bureau (NICB) indicates that over 745,000 vehicles were stolen in the first three quarters of 2022, with a 24% increase compared to the same period in 2019.

- According to the NHTSA, approximately two vehicles are stolen every minute.

FAQ About Car Insurance by VIN

Do I Need a VIN Number to Get an Insurance Quote?

Yes, providing the VIN (Vehicle Identification Number) is essential for accurate insurance quotes. It helps insurance companies assess the vehicle’s history and condition, and set the right premiums to its risk profile.

Does VIN Etching Lower Insurance?

While VIN etching (engraving the VIN on car windows) doesn’t directly lower insurance rates, it may deter theft. Some insurers offer discounts for anti-theft measures, including VIN etching.

Can You Look Up Car Insurance by VIN Number?

Generally, only authorized parties (owners, policyholders, law enforcement) can access insurance details via VIN. Some states offer public services for insurance verification using license plate numbers. The Department of Motor Vehicles may also provide this service.

Do Insurance Companies Check VIN Numbers?

Yes, insurers verify VINs during insurance policy issuance and claims. It ensures accurate information and helps assess risk.

Can I Check My Car Insurance History?

You can review your own insurance history by contacting your insurance provider or checking policy documents.