If you plan to buy a used car, be sure to check the car’s complete history before putting any money down to make sure you get the right car with a clean report and lien-free. During your search for a reliable car on an online car market, maybe you’ve seen phrases like “lien reported,” but what does that mean?

Let’s break it down so you can help yourself and avoid buying a used car with a free lien record.

What is a Lien on a car?

A lien is a legal claim placed on a vehicle by a lender or creditor, usually because the car was purchased using a loan. When someone buys a car and finances it through a leasing company or bank, the lender holds an interest in the car until the buyer has fully paid the loan.

Think of it like this: the car is not completely yours after you have fully paid the loan. If a lien is active and the borrower defaults on payments, the lender has the legal right to repossess the vehicle.

So, if you see a “lien reported” on a car history report, it means that there was a lien on the vehicle.

What does “Lien Reported” mean on a Vehicle?

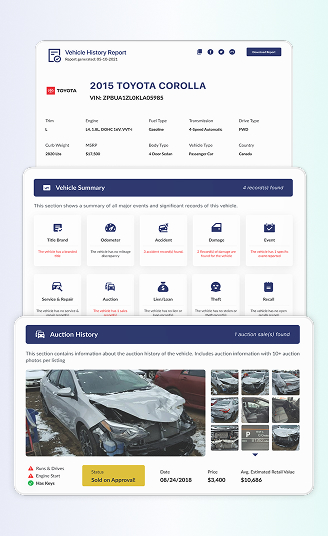

When you decode a VIN before you buy a used vehicle, you may see something like “Lien Reported” on the vehicle history report. It indicates that at some point, a lien was attached to its title. This doesn’t always mean that the lien is still active, but you need to investigate the issue further.

If the lien hasn’t been cleared, you might be in trouble if you decide to purchase the car. Here’s what you will be getting if you purchase a car with lien records attached:

- Unable to register the car under your name

- Inherit the responsibility of the unpaid loan

- Risk repossession if the lien holder claimed the car

To stay safe, make sure to check the car’s lien status by VIN to avoid legal trouble and repossession.

Should You Buy a Car With Lien Records?

Knowing the car’s lien records is not a dealbreaker. However, buying a car with a lien history is risky unless it is handled correctly. Here are a few things to consider before buying a car with a lien record

- The seller might still owe money on the car.

- If they don’t pay off the loan, you could end up losing the car or paying double.

- You may have trouble transferring the title or registering the vehicle.

Before you decide to take it home, ask the seller these questions to ensure that the car’s lien status has been cleared.

- If the lien has been paid off

- For proof, such as a lien release document

- If the title is clean and in their name

Check the Lien Before Buying

Remember to check the car’s lien status before buying to ensure you are not getting more trouble once you’ve purchased the car. Follow these steps to check the car’s lien status.

Secure the Car’s VIN

You need to have the car’s VIN in hand before you proceed with the VIN decoding process. If you don’t have the VIN, no worries; you can use the license plate.

Fill in the Form

Fill in the form with the car’s VIN or license plate along with your email address and phone number. Then, click the “Search VIN” button to begin the process.

Proceed to Payment

Review the preview of the vehicle report, then proceed to payment to get the full vehicle report.

Get the Report

Download the vehicle history report to get the information on the car lien and loan status, to ensure you did not purchase a troubled vehicle that will get you in trouble in the future.

What to do if a Lien is Found?

So you have secured the vehicle report in your hand, and you found a lien record. So, what to do now?

Ask the Seller to Pay It Off

The cleanest route is for the seller to settle the loan and get a lien release before selling.

Use Escrow

An escrow company can hold your funds and release them only after the lien is cleared.

Pay the Lienholder Directly

Arrange to pay the remaining loan balance directly to the lender, then pay the seller any extra.

Walk Away If It’s Risky

If the seller is vague or refuses to cooperate, it’s best to move on.

Clear Title vs. Lien Title: What’s the Difference?

A clear title gives you full ownership of the vehicle without any restriction, while a lien title ties the car to the lender until the car is paid off.

.

| Feature | Clear Title | Title with Lien |

| Legal Ownership | Fully owned | Shared with the lender |

| Can you Transfer Easily? | Yes | Not until the lien is released |

| Registration Issues? | None | Possible |

| Financial Risk | None | Risk of the unpaid loan |

Common Red Flags to Watch For

Pay attention to these things, it can be an indicator that the car has a lien on it.

- The seller doesn’t have the title

- The title lists a lienholder

- The seller says they’ll “mail the title later.”

- The price seems too good to be true

Always run a reliable VIN check and get yourself a vehicle history report to get a full picture of the car’s condition before buying.

Conclusion

Seeing “lien reported” on a car history report isn’t always a bad thing, but it’s a warning sign. It means the vehicle was (or still is) tied to a loan, and you need to make sure it’s fully paid off before buying. Otherwise, you could end up losing money, or worse, the vehicle itself.

You can protect yourself by running a VIN check and getting yourself a full vehicle history report to see if the car has lien records.

Frequently Asked Questions

Can I legally buy a car with a lien on it?

Yes, but you should ensure the lien is paid off at the time of sale, or you could inherit legal or financial troubles.

What happens if I unknowingly buy a car with a lien?

The lienholder can legally repossess the car, even if you paid for it. You may also have trouble registering or insuring the vehicle.

How do I remove a lien from a car title?

The lienholder must issue a lien release once the loan is paid. Then, you can apply for a clean title through your local DMV.